Download the Newsletter in PDF

Go – A new lifestyle professional

Has elapsed since a month since ILCOWORKING & LEGAL SERVICES opened its doors, offering in Madrid, a coworking space is modern, unique and accessible. Have been thirty days, with an incessant activity where we have welcomed to multiple professionals willing to have a space that goes beyond a simple place of work, providing the opportunity to be part of a community that is innovative and continuously evolving.

Coworking is a new way of working, very suitable for small business owners and self-employed persons, which provides a comfortable space to develop the professional tasks and, as is our case, where startups and entrepreneurs have a meeting point where bind to different people, with far-flung interests, but also with common objectives, aiming to grow up, relate to, or interact, with, also, of the services of a traditional office: access control, physical and mailing address, different types of rental spaces, reprographics, secretarial support, etc, all at a price that is very interesting and competitive.

We wanted to go even further, and we offer all our clients a strategy of support and advice in a legal matter or in the field of accounting, tax, or labor, in order to facilitate the decision making, as well as, in your case, a legal strategy or legal aid as effective as possible and with the highest quality standards.

In summary, IL COWORKING & LEGAL SERVICES offers the possibility of realizing a new style of professional life, where you have all our support and collaboration.

In these past thirty days, we have continued to strengthen our commitment to provide the best possible service to the entrepreneur, but also we have started another of our vocations: to offer you a series of meeting points for the professional exchange and the generation of ideas of high strategic value. A good example of this is the event that we organized last march 14, which was the kick-off of the official start of our center and where different innovative companies had the opportunity to present their experiences and to open up potential new collaborations.

Our premise is that we are not simply creating a work space. We are giving life to an ecosystem designed to nourish and enhance the success of companies.

With the intention to continue taking steps in this regard, in the Newsletter this month, we offer you a series of news which we believe may be of interest in different fields of activity, giving a response to our goal of providing practical information of the topic. We are still moving forward.

JOINT BUSINESS

The entrepreneurs expected to grow, but his concern for the regulatory uncertainty and socio-political increases.

Spanish employers rely on to grow in terms of turnover, investment and, more timid, in generation of employment in 2024, to the time they show a greater concern for the context of the political and regulatory.

As evidenced by the more than 1,350 entrepreneurs and managers who have participated in the survey Perspectives Spain 2024, conducted by KPMG in collaboration with CEOE, which this year reaches its twentieth edition.

In this way, 71% of respondents anticipated that their sales will increase in the next 12 months, compared with 70% last year, while 53% will increase their investments, compared to 50% of the previous year. For its part, a 40% expected growth of your template, 2 percentage points more than in 2023.

However, these growth prospects contrast with the concern generated by the current environment. In this regard, to evaluate the main threats to the Spanish economy, 48% highlights the legal uncertainty, a 44% points to the political uncertainty and a 30% points to the regulatory changes.

Antonio Garamendi, president of CEOE, has highlighted that “the companies we need a climate of trust, moderation, and understanding, with less uncertainty and greater regulatory quality and independence of the institutions. We need a framework that values the role of business and the company as a driver in the creation of wealth and employment”.

In regards to the current economic situation and its evolution, the entrepreneurs are shown prudent. 54% of respondents rated economic conditions as fair, compared to 57% last year.

In regards to their forecasts for the end of the year, a 45% of the participants in the survey anticipated that the Spanish economy will evolve for the worse, or much worse, a percentage similar to that of 2023 (44%), while 41% believe that you will not experience any changes.

Despite the fact that inflation has been content in the past few months, the concern for the rise of prices is maintained. Nearly two of every three respondents (63%) claim that the impact of higher prices on their profit margins have been high or very high in 2023. It is understandable, therefore, that three phenomena related to inflation are placed as major threats to the business in the next 12 months: risk of demand (34%), the volatility of the prices of raw materials (33%) and interest rates (27%).

According to the report of KPMG and CEOE, the digitization and the talent and entrenched in corporate agendas to not only be the two strategic priorities more common among respondents, as they point to the 69% in the first case and the 60% in the second, but also the two main challenges, with 63% and 62% of the sample, respectively.

In terms of the implementation of the artificial intelligence generative, the number of respondents who expected to implement it in your business in the next few months is 37% and twice that of those who have already done so, which stood at 17%. However, 29% of respondents still discards integrate it into your day-to-day. The operations and the relationship with the client are the areas in which there is a perceived greater applicability.

Forecasts of corporate operations, these remain similar to last year, as the percentage of executives who expect to close the acquisition in the next 12 months is 27%, two points higher than in 2023.

ENTREPRENEURSHIP

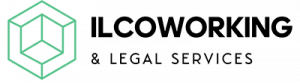

The process of evolution from a startup to a scaleup, a jump key for entrepreneurs.

The entrepreneurship ecosystem is constantly evolving and we are witnessing new trends in the world of business to which we must be especially vigilant. In this sense, up to now, we were more familiar with the term startups, but they begin to position themselves with force, the so-called “scaleup”, a form of business that is increasingly well-positioned in our economy, and which can modify the way of to conceive of the company in the near future.

The startups are emerging companies that are mainly dedicated to innovation, applicable to multiple sectors of activity. As well, when a startup crosses a first process of maturity, can be converted into a scaleup. The scaleup already has, therefore, a product or service mature, that is to say, that has some history and is cost-effective. The startups are facing, in contrast, to an early stage of development.

The Organization for Trade and Development (OECD) considers scaleups to companies that take three years in a row, growing by over 20% annual turnover or number of employees. In short, a scaleup is a company that already has the eminently pop-up of the startup, with some shooting and maturity, and needed to tackle a more ambitious goal and bring a new impetus to accelerate their presence in a given market.

This circumstance that, while the startups and scaleups agree that there are companies in growth, the reality is that we are faced with the fact that a scaleup is a company which has already been developed with accredited success in the market and now looking for a leap in quality that allows it to be more competitive. The scaleups are values that are more secure for investors, as it is not only investing in a good idea, but that is done in a business model that has already offered positive results. The scaleup has a greater potential to offer benefits, which means lower risk for those who decide to support it.

In short, although both models have in common a great idea that gives them a huge potential business level, the positive of the scaleups is that you already have a tour and a foundation that makes business ideas much more robust.

The expansion of a scaleup is usually given by the need of internationalization, its potential to expand to a different sector or the appropriateness of proceeding with the recruitment of new professionals. In other words, these companies want to ‘climb’ a project that has already proved its profitability under some specific circumstances, which is why so many ‘startups’ may end up being converted to ‘scaleups’.

TECHNOLOGY

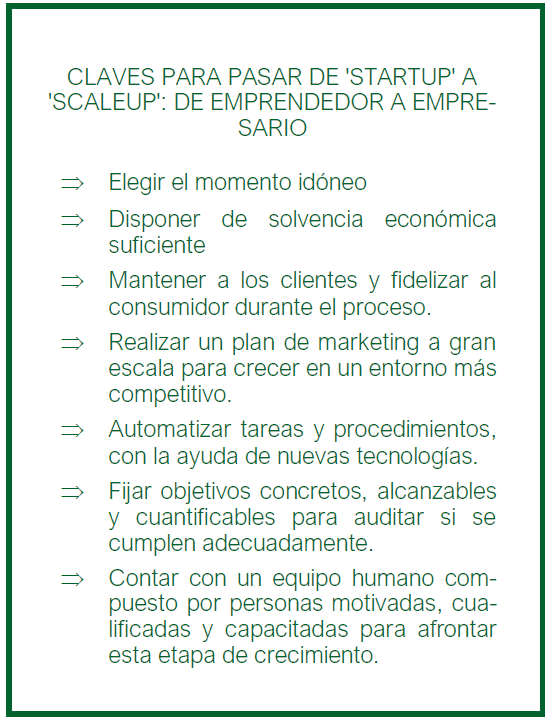

The challenge of adapting corporate culture to the artificial intelligence.

The Artificial Intelligence (AI) is revolutionizing the production processes of companies. It is a reality, and your chances increase exponentially with the passage of the months. The beginnings of AI dating back to the 1950s, but it has not been has not been up to the present time when it has increased its investment, research, and practical application. Despite the considerable uncertainties that generates its use, what is certain is that the IA has been shown to be capable of transforming entire industries, helping companies in tasks of attention to the client, data processing, decision making, process automation, and even assistance in the creative processes of writing and design.

Did you know that the EU has been the first to establish clear rules for the use of Artificial Intelligence? In fact, in a world first, the Council and the European Parliament have reached an agreement on the so-called Law of IA, which aims to ensure that the systems AI marketed in the european market and used in the EU are safe and respect for the fundamental rights and values of the EU. This legislative initiative is historical also aims to stimulate investment and innovation in AI in Europe.

There is No doubt that the Law of IA is a flagship initiative aimed at encouraging the development and adoption of AI safe and reliable in everything he single market of the EU on the part of public and private actors.

The main idea is to regulate the AI in terms of their capacity to cause harm to the society by following an approach “risk-based”: the higher the risk, the more strict the rules are. As the first legislative proposal of this kind in the world, can be a global standard for the regulation of AI in other jurisdictions, thus promoting the european approach to the regulation of technology in the world stage. The key is to fight against the misuse of AI, where the role of ethics plays a fundamental factor.

This european initiative arises at the time most suitable, as the AI is going to make the future and can offer businesses a lot more than what one can possibly imagine.

Why is it now when the whole world has begun to talk about the AI? Because the society has been able to have access to this technology in their day-to-day relatively recently, and, therefore, we were not able to imagine all the uses it could have, and how we could help to perform everyday tasks.

According to Isidoro Romero, professor of Applied Economics of the University of Seville, the application of advances in AI will generate in the coming decades a substantial impact on the productivity and competitiveness of enterprises. The AI can allow you to optimize your processes to facilitate the analysis of large volumes of data quickly and accurately, by identifying patterns, trends, and opportunities that might otherwise go unnoticed. This will allow companies to make more informed decisions and efficient. The automation of routine tasks and the optimization of supply chains will reduce also the operational costs and improve the quality of the products and services offered.

PROFESSIONAL STRATEGY

Self-employed or Limited Company: what option is right for me?

When you decide to undertake, one of the first questions that arises is: what should be a Limited Company (SL) or become autonomous? This decision is crucial since it will affect your tax burden as to the way in which you operate your business.

For that reason, before you begin a work entrepreneurs is essential to know the different legal options with an entrepreneur mind, with the object of opting for a formula that best suits your needs. Choose one option or the other may be the trigger to take on the challenge of starting a business with success or not to take the desired effects.

The entrepreneur can appreciate the option of being a self-contained natural person or to promote a project mercantile of greater substance, constituting an autonomous legal entity and creating a commercial company to such effect. In this second possibility, the self-employed have a wide range of legal concepts to choose from in case you want to become a legal entity, being the most used the Limited partnership.

The possibility of opting for one option or the other will depend on many factors, both personal, tax, labor, economic or legal, for that it would be necessary to know in depth the type of economic activity or business is intended to exercise and what are the estimates or prospects of development of business you have.

In general, unless there are reasons of economic or financial advice to the contrary, could be more practical to start with the legal formula simpler, registering as self-employed natural person. In addition, to become an autonomous person does not require any minimum amount to take, as it does not involve the disbursement of social capital as it is necessary to create a society.

With regard to the management of the daily activity, the autonomous person will meet their obligations tax and commercial with less complexity, if you decide to undertake through a trading company, since it does not have to take accounting in accordance with the Code of Commerce, or proceed to other tasks as it is the official register of auditors or process the corporate tax rate, among many other issues.

Now, a key aspect that needs to be emphasized is that the individual entrepreneur self-employed natural person assumes his or her activity with an unlimited liability, that is to say, liable of their personal assets for debts to third parties.

However, in the case of corporations, the responsibility of the employer or self employed corporate is restricted, in general, only the capital that has been provided to the company to potential situations of crisis or insolvency.

In addition, the companies can have a greater variety of expenses that you can deduct through the Tax, while, that the autonomous person has very limited possibility of deductible expenses through income TAX, even though they have been generated in the activity.

Without a doubt, the choice between being self-employed or to create a SL depends on multiple factors such as the type of activity, the volume of income, the level of risk that you are willing to take and your future plans for the business. Each option has its advantages and disadvantages, and the decision should be based on a careful analysis of your particular situation and your long-term goals. We could detail many more issues that can swing the balance one way or the other, but each case should be addressed individually, and custom, in accordance with the objectives that are pursued at the time embarking on a project.

CURRENT TAX

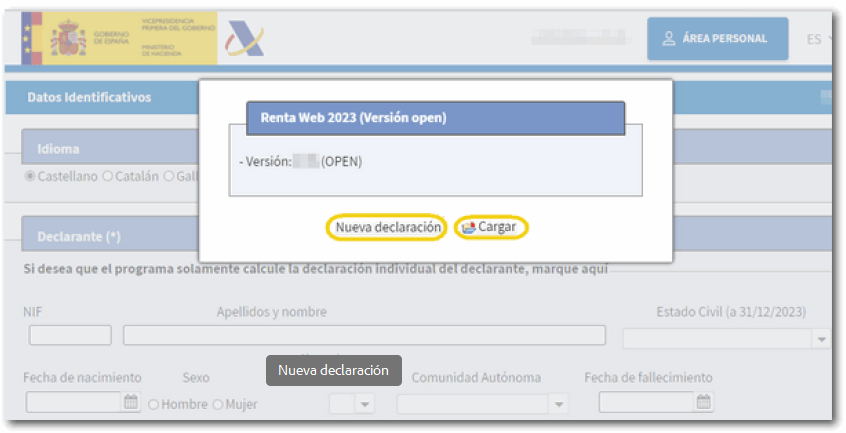

Available now, the simulator of the Income 2023, that lets you know if the statement will come to pay or return.

The Tax Agency has several ways to help the preparation and presentation of the declaration of the Tax on the Income of Natural Persons (personal income TAX). The simulator of income, through the so-called Income Web Open, it constitutes one of the main tools of support from the Administration to the taxpayers, and one of the most anticipated, along with the draft.

While the draft will not be available until the first day of the campaign, on April 3, the simulator itself, which can be used already from the 19th of march, a tool that will allow you to know the taxpayer if this year you will have to pay tax or receive a refund.

In this sense, the Tax Agency has sent an alert to the users of its mobile app to specify when you will be able to access the first data of the campaign.

This simulator is a tool that can be consulted through the website of the Tax Agency (headquarters.agenciatributaria.gob.is/), in the framework of the priority of the tax Administration to enhance the way in digital, while it retains the attention face-to-face. This last will not open until June, the last month of the campaign, as is still common in recent years.

As we say, the simulator called ‘Rent WEB Open’, a version of the platform Income WEB that draws up the statement, allows you to simulate its Income statement. Now, since the Agency warns that "does not require identification of the taxpayer, is not valid on the NIF of the declarant and you do not need to have tax data".

For this reason, the Treasury warned that this simulation does not allow the submission of the declaration. Their goal is to give a comprehensive overview of the tax.

On the other hand, the tax data of the Income 2023 will also be available from the 19th of march. It is a document that summarizes all of the income of the taxpayer bank accounts with their interests and other movements of relevance tax as housing or donations to NGOS.

With such data tax, the taxpayer will be able to "prepare and file your return of Income 202, through Income WEB, from 3 April. For his part, remember that the presentation of the income statement for the phone will begin on 5 may and in the offices will not start the preparation of statements until the 3rd of June. The campaign ends on the 1st of July.

The National court fixes to Finance: you may not be notified a few times by e-mail, and other at home to force the error of the citizen.

The Sala de lo Contencioso of the National court has considered, contrary to what is established by the Treasury department, the Tax Agency may not conduct notifications via electronic means “to will and at your convenience”, well, “the electronic notification is not a privilege of the Administration.” This case-comes of a taxpayer who had been receiving notifications at his residence in physical format, despite the inclusion of the taxpayer in the system, NEO, electronic notification.

Despite its inclusion in the system of NEO, the notifications continued to be sent to your home address in physical format. This pattern persisted even after it issued the first electronic notice subsequent to its inclusion in the system; and even if it was an electronic notification important —as it is a settlement— later returned to send a notification physics: the opening of proceedings. The National court concludes that it is not that the Administration is legally obliged to carry out what some call a “courtesy notice”, that is to say, a personal notification, in addition to the electronic notification. The central point is that, considering the purpose of the rules and the principles that underpin the system, you should require the Administration to deploy a greater diligence to “achieve the effectiveness of the notification as required by the concurrence of certain circumstances”.

TODAY COMMERCIAL

Cyber security falls squarely in the realm of "compliance".

Any business, whatever its size, can be subject to a cyber attack. For that reason, as organizations must be increasingly aware of the need to combat cybercrime, and a set of mechanisms of prevention and control and appropriate, where the programs of prevention of business integrity or compliance, to ensure the business culture of regulatory compliance, is a crucial tool and very timely. A good prevention plan in this area should assess the level of risk a company is the result of its activity, to which the innovation and the technological development should not be alien.

There is No doubt that cybersecurity has become an aspect increasingly critical and plays a key role in the strategic plans of the organizations, especially in businesses with a technological component. In the same way, the European Union, has been placed in the cybersecurity, a key pillar where it seeks to strengthen the security in the public and private organizations, aware of that, its citizens will be safe, not only against theft and leakage of data, but even in the face of acts of cyber war, more frequent and more damaging.

Until recently, the task of cybersecurity is only impacting on the departments of information security, but it is becoming more frequent, to see how organizations have locked the control and monitoring of their cyber security in the departments of compliance, since many employers are understanding that this should be a figure that pile the controls and procedures established in the organizations, whose primary objective is to maintain the computer systems harmless to the access of hackers.

This fact gives a good account of the departments of compliance, you are the true repositories of functions and tasks of control, without forgetting, of course, of the important technical work of the departments of information security, who are the first line of protection for an organization.

The contests of physical persons and self-employed persons grew by 534% in 2023 compared to 2019.

Sometimes the effort to undertake, unfortunately, does not provide the desired effects. In any case, it is necessary to know which tools are available from merchant, according to the new rules of bankruptcy proceedings, to seek legal avenues for their unwanted effects on business activity to be the minimum possible.

The Registration of Forensic Economists (REFOR) of the General Council of Economists of Spain examines the evolution of the statistics of bankruptcy, following the last data loggers published the 4th T, 2023, the trend in the first few months of 2024 and the comparison with the countries of our environment. For the period 2019-2023, since the REFOR reveal that while in these 4 years, the contests of companies have grown very moderately, 12%, contests individuals, are more independent, have increased by 534%, that is to say, they have quadrupled.

So, in 2023, nearly 80% of the contests were in the block of individuals who are more independent. In addition, the procedures for electronic micro is multiplied by more than 40 throughout 2023, from 11 in the first quarter to 463 in the fourth quarter.

Another aspect which has emerged since the REFOR is related to the significant increase in 2023 contests without mass, the so-called competitions express, that they go from being 6.955 in 2022 to 15.693 in 2023. In this regard, the forensic economists have noted that the express is a type of abbreviated procedure for companies with significant debt, no assets to face a competition and that keeps arising responsibilities to the managers of the company.

As noted by the president of the General Council of Economists, Valentine Pich,”this remarkable increase in this type of procedure, the express, reflects the fact that more and more companies flock to solve your insolvency too late, when your level of debt does not allow trading alternatives and funding, or to preserve the principle of company operation, with consequences in the destruction of employment that could lead to”.

CURRENTLY WORKING

How to interpret the report of working life.

The working life report is the document in which you can consult all of your situations of high and low in the various Social Security schemes and the number of days you've been high, in both full or limited based on your search. If you need to see the days quoted are taken into account for accounting periods minimum contribution for access to benefits, such as retirement, you'll need access to the portal, Your Social Security and check the section “See your quotes”.

To facilitate the understanding of all the information that the report provides, the State Secretariat of Social Security and Pensions has put together a guide where data that can be found in the different sections. The main steps to be taken in to consideration are the following:

1. Header: in this section you can see the logos of the organizations that issued the report: the General Treasury of the Social Security (MERCHANT), which depends on the Ministry of Inclusion, Social Security and Migration.

2. Data available in Social Security: this area contains information such as the date of issuance of the report, first name and last name, Social Security number, ID and home address. In addition, figure the total number of days in the System of Social Security.

In the vast majority of cases, the data correspond 100% to the reality, but it could be the fact that there are situations that may not be registered or to be erroneous. In such a case, if it detects one of these errors, you must file a claim data of your working life and make the information available to it.

3. Column “Regime”. The Social Security structure in regimes. In this box is the regime in which fits each period of insurance. Can be the following:

- The General Scheme. Corresponds with the work of others. The collective of artists, representatives of trade and professional bullfighting are also integrated in this regime.

- Special regime for Self-employed Workers. Here is included the Special System of Own-Account Workers of Agricultural workers.

- The Special regime of the Coal Mining.

- Special scheme for Workers in the Sea.

4. Company/Situation assimilated to the high: in this column you will find the company or the concept that has been quoted. Normally, you will see the name of a company identified with a number, which is the Account Code for a Quote. If it is you, as a self-contained, you will see the key of the province in which you are discharged.

In addition, they may appear to other situations call “assimilated to the high” as, for example, the periods in which claims the benefit unemployment (which is quoted in part), the paid holiday and not enjoyed or contributions made through a special agreement with the Social Security.

5. Date of discharge and the day from which it begins to have its effects: - The discharge date is the date on which it is listed by a situation. For example, when we enlisted in a company. Typically coincide with the date of effect, but this can sometimes vary.

6.- Date of withdrawal: this section displays the date on which it terminated the employment relationship or the situation assimilated, which coincides with the day from which we would quote.

The employer is obliged to request the high, the low, and to communicate the variations of data on all workers. The registration request must be made prior to the start of the employment relationship (up to 60 days before). In the case of requesting a low work must do so within the three days following that in which the cessation of the activity as an employed person.

7.- Contract of employment: it is the type of contract (permanent, temporary...). In this box contained the key that identifies, for the purposes of the management of Social Security, the type of the contract of work.

8.- Type of contract part time: identify the coefficient of bias on the regular working day in a company or reflected in an agreement. That is, the percentage of the working day is done. Let's not forget that since last October 1, the part-time work has been compared with the full-time job for the purposes of computation of periods of insurance required for the recognition of the different contributory benefits.

9.- Group of quote: this section records the professional category associated with the work, identified with the numbers 1 to 11.

10.- Days: the sum of all the situations determines the total number of days contributed to the Social Security from the start of your working life up to the date of issuance of the report.

Opening ceremony of IL Coworking & Legal Services

On march 14, we celebrate the inauguration of our center coworking. Among those invited to the ceremony, which included the presentation of the journalist Mar Asenjo, were companies like Zerintia Health Tech, and The Move, two innovative organizations that share our vision of a future business dynamic and full of possibilities.

This event served to open up new spaces for the exchange of ideas and the creation of opportunities for strategic development of the business. The entrepreneurs present found themselves immersed in an environment of collaboration, where every conversation could lead to a fertile partnership or new ideas. During the official presentation of our centre, Manuel Lamela, CEO-Founder of IlCoworking & Legal Services, stressed that “we are not just creating a work space. We are giving life to an ecosystem designed to nourish and enhance the success of the business.”