Download the Newsletter in PDF

Welcome. We adapt to your needs.

Discover the flexibility and dynamism of working in the heart of Madrid with ILCOWORKING & LEGAL SERVICES.

We have designed a coworking spaces to facilitate the daily performance of your professional activity or business, through a modern and accessible, with an unbeatable location. Belonging to a coworking space goes beyond simply rent a place of work; it is integrated to a vibrant community and collaborative. In these spaces, they fuse together different talents, skills and perspectives, creating an environment where creativity and innovation thrive. It is like being part of an ecosystem where each individual brings their grain of sand to build something bigger than themselves.

In our space, we found ourselves surrounded by people who are passionate and committed to their projects, who are willing to share their knowledge and experiences to help others grow. The membership of this space not only provides a physical place to work, but also the opportunity to establish meaningful connections. In ILCoworking we want the ideas to be shared freely, arising out of, collaborations in a natural way, and the atmosphere of mutual support.

On the other hand, offers a space fully equipped with a wide range of value-added services, tailored to your everyday needs, whether you are an sme, an entrepreneur or a startup. You will be able to domicile your company in our headquarters and we can also manage your correspondence or to provide you support or administrative secretariat, together with an effective advice on accounting, taxation and business law, among many other possibilities.

These services, designed to simplify the management of business, allow our customers to focus on the growth of their business, complementing the collaborative experience and enriching of our coworking space.

In ILCoworking, we are proud to offer a space designed with a focus on efficiency and flexibility. Our goal is to provide an environment where professionals can maximize their productivity while enjoying the freedom to adapt to their individual needs.

With the intention of establishing a channel of communication, which is fluid with all of our customers, we have contemplated the issuance of a monthly of this Newsletter, aimed to provide news of interest in different fields of activity and to provide you with any information is highly topical. We trust you to be from your utility.

BUSINESS ACTIVITY

The 20% of new companies corresponds to the trade sector and 18% in

real estate, financial and insurance

According to the information that you have posted this month of February, the National Statistics Institute (INE), the last month of December were created a total of 7.957 trading companies, 3.7% less than in the same month of 2022. The subscribed capital to its constitution, recorded an annual increase of 31.1% and the average capital subscribed (87.002 euros) increased by 36.3%.

For its part, the number of companies dissolved decreased by 17.8% in the annual rate. 86.7% of them did so voluntarily. The INE has also advanced that, by main economic activity, 20.1% of the mercantile companies created in December fell to the Trade, and 18.1% in real Estate, financial and insurance. In terms of the dissolved companies, 20.1% belonged to the Trade, and 15.8% to Construction.

The activity with the highest subscribed capital of mercantile companies created was real Estate, financial and insurance, with 523,09 million euros. For its part, administrative and support service Activities presented the lower capital, with 2.45 million.

From a geographical point of view, it is fair to say that Cantabria (25,0%), Extremadura (9,5%) and Aragón (6,2%) were the autonomous communities that had the highest annual increases in the number of companies created.

On the other hand, were La Rioja (-31,3%) and Illes Balears (-23,6%) of the autonomous communities that experienced the largest declines.

Provisional data 2023

Throughout the year 2023 is created 108.091 societies, a 9.1% more than in 2022. 19.2% of the mercantile companies created in 2023 fell to the Trade, and 16.9% to real Estate, financial and insurance.

In terms of the dissolved companies, 20.1% corresponded to the Trade, and 15.8% in the Construction industry.

The communities with the greatest creation of commercial companies in 2023 were the Community of Madrid (24.671), Catalonia (20.646) and Andalusia (19.167). On the contrary, the less they created were La Rioja (415), Cantabria (769) and Comunidad Foral de Navarra (805).

ECONOMIC DEVELOPMENTS

Grows the GDP than expected, but falls in business investment and slows down the consumption in households

The data in advance of Quarterly National accounts for the fourth quarter of 2023, has surprised to the upside, with a quarterly growth in GDP of 0.6%, two tenths above the increase in the third quarter. With this data, it restrains the tendency of the slowdown in activity in the latter part of the year, and the average growth of GDP in 2023 stood at 2.5%.

However, CEOE considers that it can make a positive assessment if we analyze the composition of growth. Business investment decreased by 4.8% in the quarterly rate and the consumption of Spanish households increased 0.3%, well below the previous quarter. The positive contribution of domestic demand falls on the public consumption, with a remarkable growth of 1.4%, and the contribution of inventories, which brings 0.4 points to the quarterly rate.

In this way, at the end of the year 2023, the only variable of the domestic demand that has not recovered to levels pre-crisis is investment, both of construction and the equipment, while private consumption is at the same levels as at the end of 2019.

The start of 2024 continues to be marked by a high uncertainty and balance of risks remains skewed-do to the poor. By the external component, the main risk is the geopolitical, which can lead to increases in the prices of raw materials and some turmoil in the financial markets.

And at the domestic level, the main negative impacts can be reached by an economic policy that introduce greater uncertainty and generate higher costs to the business, especially in the labour market. Accordingly, it can paralyze the decisions of consumption and investment of the economic agents. In any case, given the improvement of the growth of the activity in the latter part of the year, the outlook for 2024 could improve slightly above 1.5%.

Over the figure advanced from the fourth quarter, in the external sector, both exports and imports have shown a slight uptick, after two quarters of setbacks. In terms of inter quarterly, the largest growth in exports has led to a contribution of the external sector of a tenth of GDP growth.

By industries, there is a great heterogeneity. Thus, emphasizes the strength of the services sector, especially, in the branches of activity linked to the leisure, finance, and telecommunications. However, we observe a slowdown in the pace of quarterly advance. Meanwhile, the manufacturing industry is recovering, with increased activity for the second consecutive quarter and raised its interannual rate up to 3%, supported by the dynamism of exports and the strength of the domestic consumption.

For its part, the real estate activities are being adversely affected by rising interest rates and increased uncertainty, which is slowing down the operations of purchase and sale. And the primary sector is suffering from stagnation, both by the drought as the rise in the cost of their inputs.

The hours worked rebound and grow in the fourth quarter to 0.7%. However, the employment in terms of jobs, full-time equivalent slows down noticeably, up to a rate inter quarterly of 0.7%.

However, the employment, measured both in terms of hours worked, as in jobs, speed up your pace of growth in the straight end of 2023, to reach its rate year-on-year at 2.8% and 3.9%, respectively. This latter figure is similar to that shown in the EPA in this period.

The more intense the job compared to GDP, the productivity per worker is significantly reduced for the third consecutive quarter, with a decline of 1.8 percent year-on-year in the last quarter of the year.

STARTUPS

Advances the commitment to the circular economy, and there is a record of funding for startups in the sector of the packaging

The “Study of startups european Circular Economy” Net Zero Insights and TheCircularLab Ecoembes has analyzed the growth of the sector, startups and green circular economy during the year 2023.

The objective of achieving circularity is very present in the entrepreneurial sector, and are becoming more and more startups that focus their services to the circular pattern and the achievement of the three rs: reduce, reuse, and recycle. Thus, the “Study of startups european circular economy”, provides an overview on the progress of startups and scaleups of circular economy in Europe during the year 2023, in which sectors are concentrated the largest rounds of funding, or which are the main startups greens at the european level.

During the last quarter of 2023, the largest part of the funding to startups in the sector of the circular economy focuses on the value chain of batteries, and vehicles (with 272 million euros of investment), followed by the string of food, water, and nutrients (105 million euros) and, in the third place, the construction and building (with 85 million euros).

If we put the focus countries, the United Kingdom is situated in the last quarter of the year 2023 as the country that invests in startups of circular economy. For its part, Sweden, the leader in terms of funding throughout the year, it occupies during the last quarter of the second set, showing its dominance in the circular economy in europe. Finally, France and Italy are close, and Austria enters the top 5, with a debut worthy of mention with a single investment in Refurbed, an emerging company in the electronics industry. In particular, in Spain, we have identified 3 startups growing in 2023, IMPOSSIBLE MATERIALS and CUIMO, with headquarters in Madrid, and SCRAPAD based in Eibar, which have continued to raise 2.1 billion euros, 900 000 million euros and 5 million euros, respectively.

By focusing more attention on the startups of the packaging sector, the year 2023 stands out for achieving your best historical figures of funding. However, the packaging circulars were the only string value with a-year growth of 67 %, which demonstrates its strength and attractiveness for investors.

For his part, Frederick Cristoforoni, founder and ceo of Net Zero Insights, says: “In terms of innovation in the circular economy, the fourth quarter of 2023 reflects the trends of investment observed over a year complex for the sector. However, the maturity of european policy initiatives focused on circularity and the increase of sustainable approaches will make the circularity occupies an important place in 2024, especially in chains key as the batteries and vehicles, packaging, building and construction”.

In the words of David Ashtrays, a specialist in the field of Entrepreneurship in TheCircularLab: “despite the winter inverter to 2023 has been for the startups, we see how the sector is strengthened. The investment in startups of circular economy and, in particular, in those with a focus on the circularity of the packaging shows a strong commitment of all the stakeholders of the entrepreneurship ecosystem in a future aligned with the principles of circularity and efficiency”.

TheCircularLab is the first center of open innovation in the field of circular economy in Europe, created by Ecoembes, where he thinks and develops the recycling of the future out of the hand of an ecosystem of open innovation with entrepreneurs and startups.

For its part, Net Zero Insights is the leading platform for market intelligence for new companies and smes of climate technology.

TELEWORK

Telework is rooted in Spanish smes and returned to growth in the business during the last quarter of 2023

Telework has gained a foothold in Spanish smes as a formula to facilitate the reconciliation of the employees. This follows from the data published by the last Active Population Survey (EPA), for the fourth quarter of 2023, in which there is a growth of 19.4% compared to the same period of the previous year.

This information, obtained from the survey conducted by the National Institute of Statistics (INE) concluded that, for the first time since the end of the pandemic -the first quarter of 2021, in Spain more than three million employees work from home on a regular basis, which represents 14.9% of the population, which exceeded by much (8.3%) than it did in 2019.

However, these statistics are still very far from the rest of european economies, where telework and the rest of the models focused on improving the reconciliation are more implemented than in Spain.

With respect to the frequency with which the asalaria-two spaniards may work for self-employed persons, and businesses from their homes, EPA data showed how the hybrid model, which combines the teleworking, with the days on which it is mandatory to go to the office, he has gained weight in front of the work 100% remote.

Thus, from the end of 2020, the number of employed persons who perform full-time from home has dropped by 1.45 million. While the number of employees that teletrabajan of a flexible and casual has increased around to 960,000.

In addition, the information that emerges from the last EPA indicates that employees who teletrabajan remain more than the self-employed, a trend that is kept from the pandemic. Previously, it was the other way around, thanks to the thousands of self-employed workers who were provided -and continue to pay - their services to their customers from their homes.

Each time more and more companies are looking to retain talent, betting on measures such as the flexibility to achieve it.

So he showed it to a Report by Randstad Research and CEOE, in which it is concluded that approximately six out of every ten companies already offer the ability to enter and exit a flexible way, a measure that already has a few years of taking power, and that is in addition to others as the work-in hybrid or intensive days.

In this context, incorporate measures such as flexible working hours for employees is becoming increasingly important, given that 17% of employees spaniards have difficulties in reconciling their work and personal life.

This is an issue that affects especially the group of age between 29 and 44 years of age, and that can be solved through policies of telework or flexible schedules that allow those people who have to take care of family members such as children or the elderly the time needed to deal with the daily tasks.

Before the crisis of Covid-19, the number of teleworkers was 1.64 million. That figure reached a maximum of 3,55 million in the second quarter of 2020, the period of confinement over strict in Spain.

To compare the situation in Spain with the data of other countries, it is observed that, despite the increase in 2023, the gap with respect to the European Union has increased compared to the previous year by 2 percentage points.

So, Spain is 10.5 percentage points of the average of the EU, where almost one of every four workers carry out their work, even if it occasionally, since the home.

Among the 20 largest countries in the european union, Spain ranks 13th in the development of teleworking. According to the data of Eurostat, Spain has only improved one position from 2019.

CURRENT TAX

The digital platforms will report to the tax office for sales of over 2,000 euros or 30 operations

The Government has approved a royal decree that ends in the regulatory development of the transposition of the EU Directive 2021/514, known as DAC 7. In this way, the royal decree approved develops the rules and procedures relating to the obligation of information and due diligence relating to the disclosure statement of the operators of the digital platform, trasponiendo the DAC 7 and implemented the Multilateral Agreement between competent Authorities on automatic exchange of information related to income earned through these digital platforms in the area of the OECD.

In particular, set out the procedures to be applied by certain operators silver-digital forms and details the terms of the new registration obligations and information on these operators.

This measure will affect those vendors using transactional services on digital platforms have sold 30 items or more, or received more than 2,000 euros of sales.

Among the activities which are the subject of the report, called by the Board as a “relevant activities” are the following:

– The lease of real property, including immovable property for residential and commercial use and any other type of immovable property, as well as parking spaces.

– The personal services.

– The sale of “goods”.

– The lease of any means of transport.

It is important to note, that it is the income earned by vendors independent of the platform, that is to say, no obligation in the case of a company that sells its products online, but when there is an independent salesperson that sells its products or providing its services through the platform.

The operators shall apply the procedures of ‘diligence’, with special attention to the residence, to verify and process the information of the sellers on their platforms, or who provide services to users, with the exception of the government and the market. The platforms shall identify the operators themselves and the vendors, the activities, the payment to the seller and the identification of accounts receivable, as well as taxes, commissions, fees or other amounts withheld or collected.

Amended the Regulations of income TAX in respect of income tax withholdings and payments on income from employment

The recent elevation of the amount of the minimum wage to 15.876 euros annually carried out by the Royal Decree 145/2024, 6 February, which fixed the minimum wage to 2024, involves a review of the regulation of the Regulation of the Tax on the Income of Natural Persons in order to avoid that the taxpayers who perceive yields of the work by a value equal to or lower than the minimum wage support withholding or payment on account. As well, the Royal Decree 142/2024, 6 February (official gazette of February 7, in force on and with effect from 8 February), amending the Regulation of the Tax on the Income of Physical Persons, approved by Royal Decree 439/2007, march 30, in the matter of withholding and income account.

Thus, rises 5.565 to 7.302 euros the tax credit for earned income in the income tax rate for the lowest wages. The measure will prevent the rise in the minimum interprofessional salary (SMI) from the x 1080 euros in 2023 to 1.134 euros (for 14 to pay) this year will translate into a higher income tax treatment.

In addition to raising the deduction for income from work, the royal decree approved by the Council of Ministers amending the regulations of the personal income TAX, raised the minimum exempt from withholding of income TAX (from the 15.120 euros in 2023 to 15.875 euros in 2024, the same amount as the annual SMI). In this way, according to Montero, ensures that the SMI will arrive intact to their recipients, without suffering any retention.

to rise in the minimum exempt level of retention is translated, in addition, a sale of the deductions to the gross income of up to $ 22,000.

TODAY COMMERCIAL

Policy accounting: new definitions of the companies based on their size

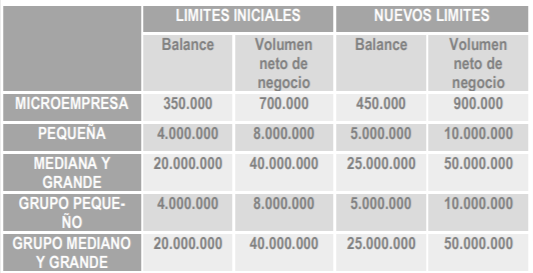

Before the important inflation in 2021 and 2022, the European Union has set the thresholds by which it establishes the classification of micro, small, medium and large companies, through the Directive 2013/34/EU of the european Parliament and of the Council of 26 June 2013 (THE ACT 10607/2013) on the annual financial statements, the consolidated financial statements, and other reports related to certain types of companies, known as the "Policy accounting". The objective of the Directive is to facilitate the cross-border investment and to improve in the EU, the comparability of the financial statements, as well as higher quality information.

Under this Policy, for the year 2024 is intended to be modified with very significant impact in some of the rules of trade, among others, the Corporations Act, which sets the limits that allow these entities to formulate balance and memory shortcuts, as well as do not have the obligation to prepare the statement of changes in equity, the cash flow statement and the management report.

Could also be modified to the Overall Plan of Accounting for smes, which allows its application to all companies that are small in accordance with the above Policy limits.

Increase the litigation practices of the ESG in the companies

A new analysis by the World Business Council for Sustainable Development (WBCSD) reveals that the lawsuits against companies related to issues ESG have grown 25 % in the last three decades.

This report highlights three key trends:

• More litigation involving supply chains: There is an increase in litigation related to ESG against companies because of their subsidiaries and suppliers.

• Regulatory frameworks and policies: there is an increase in disputes that quoted due diligence requirements preventive relating to inform or to keep a "standard of care".

• Soft laws are coming into play: the majority of the cases related to the due diligence are based on sources of law soft law), as the Convention of Biodiversity, the OECD Guidelines and the like.

What is certain is that the proliferation of demands on topics ESG is driving many companies to adjust the way you communicate the environmental, social and governance. Also is prompting a growing number of companies to seek legal advice and subject matter experts.

With the growth in the tendency of companies to have legal guidance to address disputes in the field of ESG, that is to say, related to the criteria of environmental, social and governance, it is also advisable for the companies to anticipate and implement prevention policies that avoid litigation unwanted, in addition, can have serious implications it may have in terms of reputation and social responsibility.

Many experts agree that the policies in the field of ESG will check companies this 2024. The pressure on organizations to comply with the directives, and the uncertainty brought about by these criteria, for them, means that more than 70% of the company lawyers think that it is one of the potential threats of lawsuits for this year.

Also is prompting a growing number of companies to seek legal advice and subject matter experts.

CURRENTLY WORKING

Reminder of the developments in the field of Social Security for this year

This year, enters into force on important developments in the field of Social Security; some are as common as the annual revaluation of pensions, according to the latest reform will maintain their purchasing power with a rise of 3.8%, and others are specific to 2024 as the right to quote for all the interns, internships paid or unpaid. Let's review the salient measures.

Revaluation of pensions

Contributory pensions shall be revalued 3.8% in 2024. This increase of 3.8% to 2024 is the result of the consumer price index (CPI) between December 2022 and November 2023, according to the formula set out in the Law 20/2021 guarantee the purchasing power of the pension, and agreed with the social partners.

Minimum pensions and non-contributory pensions will increase by a higher percentage, based on what is established in the Royal Decree-Law 2/2023 that culminates in the reform of the public pension system. In the case of the minimum pension, since January 1, the progressive increase will be fixed in the evolution of the minimum wage on a path of convergence for these pension (taking as a reference the minimum pension allowance) to rise by a percentage in addition to the annual re-linked to the CPI to converge with the 60% of the median income of a household with two adults in 2027.

For the non-contributory pension is set in a similar process, will grow to converge on that same year, with 75% of the poverty threshold calculated for a one-person household. January 1, 2024, the amount of reference will increase further in the percentage needed for a 20% reduction in the gap that exists.

Quote of practices

All college and university students and vocational education and training who perform practical training or academic practices external (paid or unpaid) that are included in training programmes contribute to Social Security since January 1, 2024, and will have a greater protection. Until now, there was only the obligation to enlist the students who carried out paid internships.

Increased contribution bases

The 1 of January has entered into force, the other of the measures included also in the Royal Decree-law 2/2023 that sets the annual updating of the maximum contribution bases of the different regimes, under the corresponding Law of General Budgets of the State (LPGE), shall be in a percentage equal to that set forth for the revaluation of contributory pensions, to which is added an annual increase of 1.2 percentage points, with the aim of increasing the resources of the Social Security.

Mechanism of Intergenerational Equity (MEI)

The application of the Mechanism of Intergenerational Equity (MEI) to provide greater resources to the Reserve Fund of the Social Security began in 2023, but is increased in this 2024 (also linked to the LPGE) and will be 0.70 percentage points, of which 0.58 correspond to the company and 0.12 to the worker.

Retirement age

In 2024 the legal retirement age will reach 66 years and 6 months for carraras contribution of less than 38 years, while in the 65 years for which they have 38 years or more quoted, in application of the Law 27/2011.

A complement of gender gap

The amount of the add-gender gap will be subject to an additional increase of 10 % on the value provided in the biennium 2024-2025, which will be distributed between both years, as determined by the respective laws of general budgets of the State.

Partial retirement

Modified the age of access to the partial retirement in function of the years listed. In 2024 will be 62 years and 6 months for people with 36 years or more quoted and 64 years of age with 33 years quoted at the time of the event triggering.

Coefficients lowering of the retirement age

Since January 1, shall be applied gradually coefficients lowering of the age of voluntary early retirement when the pension exceeds the maximum limit in function of the years listed. Can be consulted on the website of the Social Security application tables of coefficients

WE REINFORCED OUR SERVICES

IL Coworking & Legal Services expands its portfolio of services with the agreement signed with the law firm Acountax Madrid

IL COWORKING & LEGAL SERVICES has signed a partnership agreement with the signature ACOUNTAX MADRID, by which all our customers, if they so wish, will be able to access important value-added services.

Under this agreement, IL COWORKING & LEGAL SERVICES provides optional services, support and advice for freelancers and entrepreneurs that include the possibility of domiciliation corporate, management, administrative and secretarial assistance, as well as in the field of accounting, taxation or support of such legal in all branches of law that covers the signature ACOUNTAX MADRID.

To all the customers of IL COWORKING &LEGAL SERVICES has provided a system of tariffs, and fees special that will facilitate access to the experience and expertise of the team of lawyers of ACOUNTAX MADRID.

In the modern era, where technology has blurred the traditional boundaries of the workplace, there arises a crucial question: how is it more productive to work from home or from an office?

This question is especially relevant for the coworking spaces that seek to attract customers by providing an optimal environment for professional performance.

Working in an office or a coworking space comes with its own benefits. These spaces are designed specifically to enhance the productivity.

The coworking spaces modern have evolved to offer the best of both worlds. They offer the flexibility and comfort of a home, together with the structural advantages and collaborative of a traditional office. Many coworking spaces are equipped with cutting-edge technology, meeting spaces and breakout areas, all designed to maximize productivity and comfort.